By: Azhar Azam

As Russia chases the United States footsteps of employing military power in Middle East to plunge its vicious economic crisis prompted by falling oil prices and western sanctions, the recent conflict with Turkey could deepen the graveyard of its economy.

A sudden deployment of military jets to patronize Asad’s regime and chuck out ISIS or IS in Syria took the world by surprise. At the same time, Russia didn’t even bother to listen into instinctive stark reaction of Turkey, one of its strongest trade partners and a NATO member.

The stage was all set for intense conflict and downing of Russian fighter jet by Turkey defense forces on November 24 and latter shooting of a Russian SU-24 bomber for violating its territorial integrity ballooned in the strife.

Russia Sanctions on Turkey

Russia repeatedly threatening Turkey for dire consequences eventually responded with raft of economic sanctions including fruits and vegetables such as tomatoes, cucumbers and apples, poultry products and salt with effect from January 1, 2016.

The decree further suspends chartered flights to Turkey spoiling the business of Russian tour operators who generally used to milk high revenues in ongoing long winter season by providing middle class Russians seeking some sort of lull in Turkey. In 2014, it was about 4.4 million Russian, including 3.3 million tourists who visited Turkey. Then there is the elimination of visa waiver facility for Turkish transport companies enforcing them to apply for formal requests.

Bilateral Trade and Alternative Options for Turkey

The annual bilateral trade between the two countries is app. $31.23 billion where Russia is the largest import partner of Turkey with $25.29 billion, 10.4% of total imports whereas Turkey’s exports to Russia are just $ 5.94 billion, 3.8% of total exports. The ratio of Russia and Turkey bilateral trade is 81:19 so what Russia would be thumped by four times than of Turkey in case of entire trade ties are delinked.

The imposition of these sanctions may force Turkey to search for alternative sources to replace Russian gas and LPG. Remember, Turkey is one of the largest natural gas consuming countries and ranked 8th in the world, about 49 billion cubic meters as of 2014. (World Factbook)

The imposition of these sanctions may force Turkey to search for alternative sources to replace Russian gas and LPG. Remember, Turkey is one of the largest natural gas consuming countries and ranked 8th in the world, about 49 billion cubic meters as of 2014. (World Factbook)

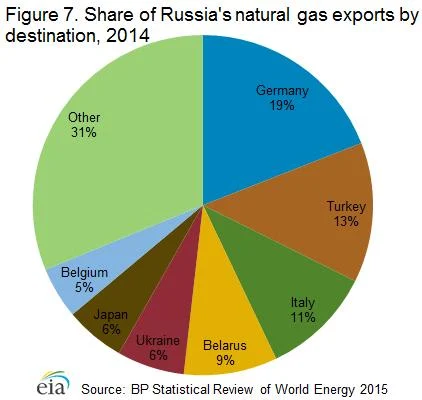

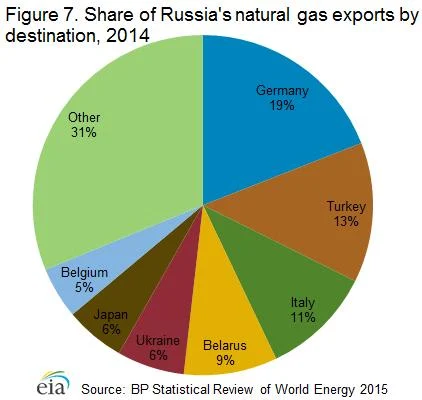

According to EIA, Turkey imported 13% of the Russian total natural gas exports in 2014, second largest after Germany’s 19%. Furthermore, Turkey is ideally placed to supply Russian natural gas to Europe and any kind of restriction in supply of gas to Turkey could blot Russian ambitions to reach Europe while Turkey can fill its LPG shortfall through Middle East, Algeria, Georgia and United States.

Though Russian officials are denying any sort of interruption in the contracts of the gas supply but Turkey is already taking precautionary measures for smooth, continual gas supply through its allies in Middle East.

Qatar, a biggest exporter of liquefied natural gas (LNG) and one of the close allies of Turkey is expected to push the gas supply to meet the shortfall. In September 2014, both the countries signed an accord where Qatar will provide 1.2 billion cubic meters of LNG to Turkey through tankers. Qatar who exported 76.8 million ton of LNG in 2014 certainly encompass the capacity to fill the space if set free by Russia. Algeria and Nigeria could also be the beneficiaries in eventuality of such turmoil.

On the other hand, natural gas traders from United States are eying the situation and may increase their share in Turkey from 6% to 12-14% in 2016, according to Reuters. The report further exposed that 21% of Russian global LPG exports of 5.2 million tons was supplied to Turkey, 1.1 million tons that is.

European nations too will extending full support to Turkey and announced a grant of $3.2 billion in aid in return of Ankara’s cooperation in stemming the flow of refugees from Syria.

But the question arises, will Russia be able to survive such economic drain while already packed in by western sanctions over its Crimea annexation coupled with interference in Ukraine and falling oil prices internationally?

Russian Economy – Past, Current and Future

Russian economy though had averaged 7% growth from 1998 to 2008 mainly due to rise in oil prices, has shrunk to 3.4% in 2012, 1.3% in 2013 and just 0.6% in 2014. In the second half of 2014, ruble lost almost half of its value whereas the economy is expected to contract by 3% in 2015.

The foreign exchange and gold reserves have fallen to $385 billion in 2014 from $509 billion in 2013; exports have reduced to $497 billion in 2014 from $523 billion in 2013; inflation has inflated to 7.8% in 2014 from 6.8% in 2013 and unemployment rate has escalated to 5.5% in 2014 from 5.2% in 2013. (World Factbook)

Year 2015 hasn’t either rolled the dice impeccably for Russia since ruble has collapsed to 67/dollar from 33/dollar on 03-December-2015 in two years; primary budget registered a deficit of 0.6% during January – September 2015 compared to 2.9% surplus a year ago and foreign reserves have curtailed to $370 billion in early October. Finance Minister Anton Siluanov has said that the budget deficit may exceed 3% next year as oil prices are expected to fall below $40/barrel.

Under the given circumstances, it would not be undemanding and practical for Russia to either stick to the sanctions imposed or enlarge them on Turkey as it would hurt Russia much more than it would hurt Turkey and similarly Turkey is no short of number of allies to fulfill its energy and other needs whereas Russia would off course!

As Russia chases the United States footsteps of employing military power in Middle East to plunge its vicious economic crisis prompted by falling oil prices and western sanctions, the recent conflict with Turkey could deepen the graveyard of its economy.

A sudden deployment of military jets to patronize Asad’s regime and chuck out ISIS or IS in Syria took the world by surprise. At the same time, Russia didn’t even bother to listen into instinctive stark reaction of Turkey, one of its strongest trade partners and a NATO member.

The stage was all set for intense conflict and downing of Russian fighter jet by Turkey defense forces on November 24 and latter shooting of a Russian SU-24 bomber for violating its territorial integrity ballooned in the strife.

Russia Sanctions on Turkey

Russia repeatedly threatening Turkey for dire consequences eventually responded with raft of economic sanctions including fruits and vegetables such as tomatoes, cucumbers and apples, poultry products and salt with effect from January 1, 2016.

The decree further suspends chartered flights to Turkey spoiling the business of Russian tour operators who generally used to milk high revenues in ongoing long winter season by providing middle class Russians seeking some sort of lull in Turkey. In 2014, it was about 4.4 million Russian, including 3.3 million tourists who visited Turkey. Then there is the elimination of visa waiver facility for Turkish transport companies enforcing them to apply for formal requests.

Bilateral Trade and Alternative Options for Turkey

The annual bilateral trade between the two countries is app. $31.23 billion where Russia is the largest import partner of Turkey with $25.29 billion, 10.4% of total imports whereas Turkey’s exports to Russia are just $ 5.94 billion, 3.8% of total exports. The ratio of Russia and Turkey bilateral trade is 81:19 so what Russia would be thumped by four times than of Turkey in case of entire trade ties are delinked.

According to EIA, Turkey imported 13% of the Russian total natural gas exports in 2014, second largest after Germany’s 19%. Furthermore, Turkey is ideally placed to supply Russian natural gas to Europe and any kind of restriction in supply of gas to Turkey could blot Russian ambitions to reach Europe while Turkey can fill its LPG shortfall through Middle East, Algeria, Georgia and United States.

Though Russian officials are denying any sort of interruption in the contracts of the gas supply but Turkey is already taking precautionary measures for smooth, continual gas supply through its allies in Middle East.

Qatar, a biggest exporter of liquefied natural gas (LNG) and one of the close allies of Turkey is expected to push the gas supply to meet the shortfall. In September 2014, both the countries signed an accord where Qatar will provide 1.2 billion cubic meters of LNG to Turkey through tankers. Qatar who exported 76.8 million ton of LNG in 2014 certainly encompass the capacity to fill the space if set free by Russia. Algeria and Nigeria could also be the beneficiaries in eventuality of such turmoil.

On the other hand, natural gas traders from United States are eying the situation and may increase their share in Turkey from 6% to 12-14% in 2016, according to Reuters. The report further exposed that 21% of Russian global LPG exports of 5.2 million tons was supplied to Turkey, 1.1 million tons that is.

European nations too will extending full support to Turkey and announced a grant of $3.2 billion in aid in return of Ankara’s cooperation in stemming the flow of refugees from Syria.

But the question arises, will Russia be able to survive such economic drain while already packed in by western sanctions over its Crimea annexation coupled with interference in Ukraine and falling oil prices internationally?

Russian Economy – Past, Current and Future

Russian economy though had averaged 7% growth from 1998 to 2008 mainly due to rise in oil prices, has shrunk to 3.4% in 2012, 1.3% in 2013 and just 0.6% in 2014. In the second half of 2014, ruble lost almost half of its value whereas the economy is expected to contract by 3% in 2015.

The foreign exchange and gold reserves have fallen to $385 billion in 2014 from $509 billion in 2013; exports have reduced to $497 billion in 2014 from $523 billion in 2013; inflation has inflated to 7.8% in 2014 from 6.8% in 2013 and unemployment rate has escalated to 5.5% in 2014 from 5.2% in 2013. (World Factbook)

Year 2015 hasn’t either rolled the dice impeccably for Russia since ruble has collapsed to 67/dollar from 33/dollar on 03-December-2015 in two years; primary budget registered a deficit of 0.6% during January – September 2015 compared to 2.9% surplus a year ago and foreign reserves have curtailed to $370 billion in early October. Finance Minister Anton Siluanov has said that the budget deficit may exceed 3% next year as oil prices are expected to fall below $40/barrel.

Under the given circumstances, it would not be undemanding and practical for Russia to either stick to the sanctions imposed or enlarge them on Turkey as it would hurt Russia much more than it would hurt Turkey and similarly Turkey is no short of number of allies to fulfill its energy and other needs whereas Russia would off course!